The orchestration of storage is a small science in itself and requires first of all the identification of the information to be stored. A lot of data can be stored in the cloud with relative ease, while more sensitive data is better left in the cloud. Many sensitive data must be stored securely for many years by law and therefore belong in the long-term archive. For most other data, it is sufficient to include it in the backup or secure it with a proper raid.

Availability also plays a not inconsiderable role in the selection of the storage location - this applies to access speed, as well as to the recovery of data in the event of damage or loss through appropriate mirroring or backup on hard disks or a tape library. As a rule, the higher the availability of the data, the more complex the infrastructure to be provided for this purpose with high-performance storage systems, high bandwidths, multiple redundancy, expensive service contracts with short response and recovery times. If data can be qualified according to availability requirements, there is a considerable savings potential if the necessary provision time can be reduced.

Beyond the fiscal retention periods, there are a whole range of industry-specific peculiarities, such as in medicine: Since a patient's civil law claims against his doctor are subject to a 30-year statute of limitations under the German Civil Code, the corresponding documents, such as X-rays and findings, should be available for a correspondingly long time. Insurance companies and banks also often maintain long-term business and contractual relationships, which requires a correspondingly longer retention of documents.

Retention periods recommend the storage location

The tax office specifies a retention period of at least 10 years for all tax-relevant documents, such as incoming and outgoing invoices, balance sheets and annual reports, bank and accounting vouchers and certain commercial contracts, during which time the relevant documents must be accessible in the event of a tax audit. In this case, the obligation to preserve records is also specified in the DSGVO, which provides for the possibility or obligation to delete certain information.

For these data a long-term archive on optical data carriers is recommended, which are unchangeable and with appropriate durability, on the one hand comply with the legal requirements and on the other hand save energy and help to reduce service costs due to their longevity.

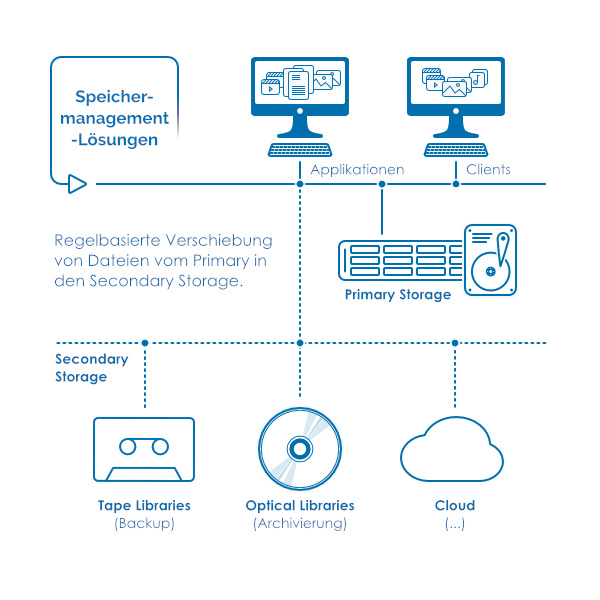

Storage management creates freedom

The task to store which data where can be done by a storage management software like PoINT Storage Manager, which directs the data streams into the right direction by default. The middleware does not only make optimum use of the available resources, but also creates free space when using appropriate hardware like a HIT-Netzon Library or a StorEasy WormAppliance, since, for example, data in an optical long-term archive do not have to be included in the backup and thus reduce the backup volume.